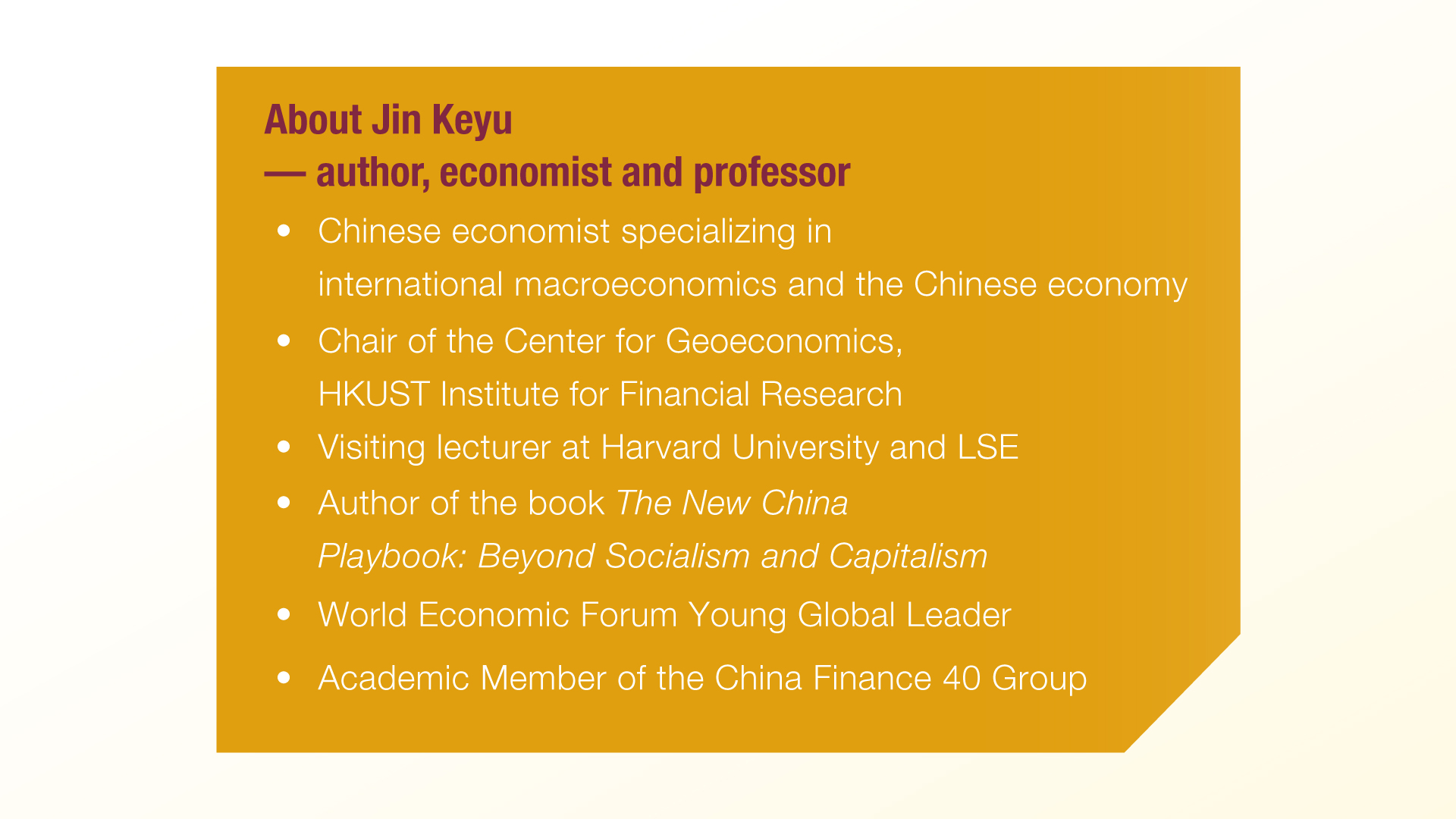

Professor JIN Keyu, Chair of the Center for Geoeconomics, HKUST Institute for Financial Research, discusses how shifting political alliances, technological advances, and new investment priorities are reshaping the global economy in an era of deglobalization.

Even before the latest tariff uncertainties hit, the global economy was poised for a transformative period of change. Shifting political alliances, rapid technological advancements, and evolving investment priorities were beginning to reshape the economic landscape.

For everyone from presidents and policymakers to financiers and small business owners, that poses a whole new set of challenges in determining which path to take and where it may lead.

In general, though, what they can see is that the world is entering an era of deglobalization, moving away from the principles that previously sought to lower trade barriers and champion the benefits of offshoring, outsourcing, and multilateralism.

The Rise of Regionalism

One inevitable consequence is that the network of global supply chains connecting producers and manufacturers to end users will alter. Another is that nations will seek out new alignments, trusting more in regional trade blocs and bolstering local economies to guard against the unpredictability of political moods and market swings elsewhere.

Behind all this, of course, is the predominant issue of our times: the increasingly tense rivalry between China and the US – the world’s two largest economic powers – and how it will play out.

According to Professor Jin Keyu, Chair of the Center for Geoeconomics, HKUST Institute for Financial Research, the current fragmentation of geopolitical norms can be expected to have wide- ranging effects on governments, inflation, and the global financial system as the process unfolds.

China’s Alternative Approach

Significantly, though, a few countries, including China, are fighting against the prevailing trend and taking a very different approach from that presently advocated in the US.

“Instead of polarization, China wants to be more open than ever and is holding up that banner,” said Professor Jin, a respected authority on the competing forces reshaping macroeconomics and international trade. “So, a lot is being done to boost demand with countries and economic blocs that are not into protectionism and want to keep moving forward.”

This stems from the belief that globalization should not be seen as a simple matter of winners and losers. The value of the flow of goods between trading partners can never be perfectly equitable, but lasting benefits accrue in other ways, which tend to balance things out.

“It is best to deliberate on these issues with a clear mind and not just think about the calculations of a domestic political process,” Professor Jin said. “When talking about macroeconomic changes, people may underestimate the effects. They don’t necessarily see the embedded inflation, that growth prospects will be less rosy, or that there will be much less sharing of economic and financial risk, which has been one of the great things about globalization.”

She added that in the U.S., in particular, some among the business elite may prefer an old paradigm, but those days are gone.

A Fundamental Reordering

The rise of China has been so significant in different ways – politically, culturally and commercially – that a fundamental reordering within the global economy is inevitable.

The change will continue to be driven by China’s links with newly influential trading blocs such as ASEAN (the Association of Southeast Asian Nations) and the RCEP (Regional Comprehensive Economic Partnership). It will also be underpinned by the country’s still robust manufacturing sector, homegrown enterprises leading the way in technology and innovation, and trade strategies designed to resist external shocks and avoid over-dependence on single markets.

“Many countries want to learn from the China model as a developmental paradigm,” said Professor Jin, whose bestselling book The New China Playbook: Beyond Socialism and Capitalism was selected as a Financial Times “must read” in 2023. “What it represents paves the way for different blocs and for the digitalization of areas like services trade, which will overtake traditional trade in due course.”

The Shift to Services

Statistics show that global manufacturing reached its peak before the financial crisis of 2008. However, trade in intermediary services has been rising at a steady rate and now accounts for up to 30-40% of GDP in some advanced economies.

“Technology, including large language model AI, can only accelerate that trend, and it will bring new efficiencies,” Professor Jin said. “There is a richness of cross-border data at macro and micro levels that explains what is happening in global networks and with financial flows around the world. It shows clear structural changes and helps us learn about e-commerce, digital currencies, payment channels, and what it all means.”

She added that each of these developments should be understood and accepted as part of a logical economic evolution. So, there is no cause to assign blame if, for example, factory jobs move from China to Southeast Asia or Sri Lanka.

Instead, informed discussion should focus on the reasons and socio-economic benefits. That includes affordable prices for the average consumer, better prospects for lower-paid workers which ultimately will create broader wealth distribution, and opportunities to invest in new tech-inspired industries, which promise to generate more than attractive returns.

Opportunities in Emerging Sectors

Already, these opportunities can be found in areas ranging from green energy and electric vehicles to quantum computing and robotics.

Excitement is building about AI-enabled research in fields like biotech and pharmaceuticals, with the potential for medical breakthroughs that can have a huge impact on humanity. And, as society ages in many countries, especially in Asia, much thought is being given to meeting the needs and redeploying the skills of the older generation in an expanding gray economy.

“In the workplace, many tasks will be displaced, but many jobs will also be enhanced by AI and other technologies,” said Professor Jin, who earned her PhD from Harvard University and is a visiting lecturer there and at the London School of Economics and Political Science (LSE). “The new technology can lead to higher productivity and higher pay; people should not be afraid of the consequences of job replacement.”

A Dynamic Future

Overall, Professor Jin sees a dynamic period ahead for China, Asia, and the global economy, with greater fragmentation in some areas, but greater cohesion in others.

“There may be less focus on geopolitical alliance and more on the importance of shared economic development,” she said. “In that respect, China is a very competitive country and can assert its influence.”